Your emotional connection to money impacts everything—how you earn, spend, save, and even discuss finances. Here are some common emotional money struggles:

- Guilt & Overspending: Feeling bad for treating yourself? Do you lend money to family out of obligation? Guilt can lead to emotional spending.

- Fear & Hoarding: If you’ve worked hard for financial stability, the fear of losing it all can cause over-saving—and not enjoying your money.

- Shame & Avoidance: Past financial mistakes can make you avoid budgeting, checking your accounts, or facing debt.

💡 Breaking the cycle starts with recognizing these emotions.

🔥 Why Your Relationship with Money Matters

When was the last time you had an honest conversation with yourself about money? Not about this month’s bills or next year’s savings goals, but about the emotions tied to how you spend, save, or even give? If your finances feel like they’re running the show instead of you, it’s probably time to dig deeper into the emotional side of money.

For first-generation wealth earners and millennial financial health enthusiasts, this conversation is especially crucial. Many of us haven’t just inherited money habits—we’ve inherited emotions tied to those habits. Fear, guilt, pride, or even shame—how we feel about money can shape our financial decisions more than any budget spreadsheet.

Here’s some good news, though: your emotional relationship with money doesn’t have to be written in stone. It’s time to flip the script and make your money work for you, not the other way around.

What Is Emotional Finance?

“Emotional finance” might sound like a buzzword, but it’s a concept that dives deep into how our feelings influence financial decisions. This means everything from the guilt you might feel when splurging on yourself, to the pride of supporting family members as the “first-gen success story,” to the fear of not saving enough for the future.

While traditional financial advice often focuses on numbers—income, expenses, and investments—emotional finance looks at the “why” behind your money choices. It connects your thoughts and feelings with your financial habits, shining a light on patterns that could be holding you back.

Why Your Relationship with Money Matters

Think about it—your relationship with money impacts your daily life more than almost anything else. How you feel about spending, saving, or even earning can either propel you toward financial growth or keep you stuck in unhealthy cycles.

Some of the common emotional themes millennials and first-gen wealth creators face include:

- Guilt and Overspending: Do you feel guilty about treating yourself or lending money to family? This might lead to overspending in an attempt to add value to your relationships or validate your success.

- Fear and Hoarding: Fear of losing it all (especially if you’ve worked hard to achieve stability) can lead to unnecessarily hoarding money without enjoying the fruits of your labor.

- Shame and Avoidance: Shame around past financial mistakes can result in avoiding hard conversations like budgeting or addressing debt.

The good news is, this cycle can be broken. And the first step is identifying these emotions and understanding how they play into your decisions.

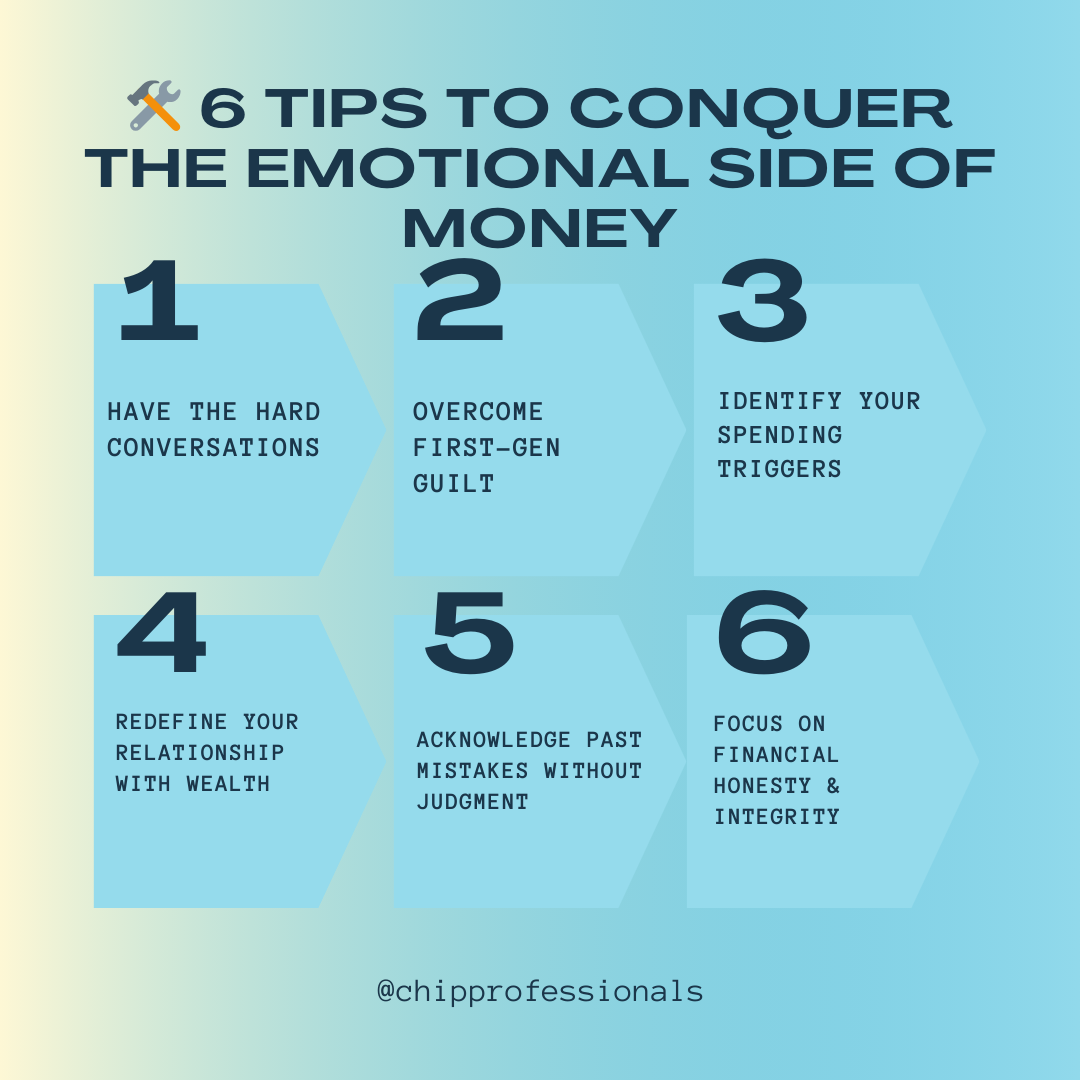

6 Tips to Conquer the Emotional Side of Money

1. Have the Hard Conversations

Money can often feel like a taboo topic—especially within families. Whether it’s about contributing to holiday spending, clarifying expectations about financial support, or just understanding your partner’s money behavior, honesty is key.

Sit down with your loved ones and be open about financial boundaries. It might feel awkward at first, but transparency builds healthier relationships and reduces financial stress down the line.

2. Overcome First-Gen Guilt

First-generation wealth earners often feel a deep sense of responsibility to provide for their families. While helping loved ones can be rewarding, it shouldn’t leave you drained financially or emotionally.

Create a budget that includes what you’re able to give without overextending yourself. Remember, saying no doesn’t make you selfish—it shows respect for your own financial well-being.

Check out Gloria Cisnero view on it

3. Identify Your Spending Triggers

Do you shop to feel better after a tough day? Or maybe you convince yourself you “deserve” that expensive outing because you’ve worked hard this month. Emotional triggers can often push us toward unnecessary spending.

Next time you’re about to hit “add to cart,” take a pause. Ask yourself whether the purchase aligns with your core financial goals or if it’s an emotional reaction.

4. Redefine Your Relationship with Wealth

Stop equating wealth with material things. Owning designer bags or driving luxury cars doesn’t necessarily mean financial success.

Redirect your focus toward building real wealth—one that isn’t just measured in possessions but in freedom, peace of mind, and long-term security.

5. Acknowledge Past Mistakes without Judgment

Maybe you racked up debt buying things you didn’t need, or ignored your savings for too long. It’s important to own these mistakes without letting them define you.

Learn from them, make a plan to address them, and take actionable steps toward a healthier relationship with money.

6. Focus on Financial Honesty and Integrity

Be honest—not just with your loved ones, but with yourself. Are your current financial habits helping or harming your long-term goals?

Sometimes, making progress means setting systems and boundaries. For example:

- Use automated savings to remove the temptation to spend.

- Set “no-spend” days to break impulse shopping habits.

- Regularly review your budget to ensure it aligns with what matters most to you.

Why Emotional Finance is the Key to Financial Well-Being

Understanding the emotional side of money isn’t just about fixing financial mistakes; it’s about building a life you feel good about. Unchecked emotions—whether it’s guilt, fear, or pride—can lead to unnecessary stress and derail your financial goals. But by addressing these feelings head-on, you empower yourself to make intentional, mindful money decisions.

It’s not just about the dollars and cents—it’s about creating a system that protects your mental health, supports your goals, and allows you to enjoy what you’ve worked for.

Take Control of Your Money Narrative

If your money has been calling the shots, it’s time to flip the script. By addressing the emotional side of finance, you can take back control and craft a financial story that works for you, not against you.

Want to go deeper? Watch our webinar, “Money Talks, But It’s Probably Gossiping Behind Your Back – Let’s Fix That,” and take the first step toward improving your financial well-being.

Your financial freedom—and peace of mind—is just one honest conversation away.

Find Your Financial Friend on the CHIP App! 💰✨

Looking for a financial professional who understands you? The CHIP app connects you with diverse financial experts who can guide you on your wealth-building journey.

🔹 Personalized financial advice

🔹 Trusted professionals who get your goals

🔹 A supportive community for your money moves

📲Create a FREE Profile CHIP app today & start building wealth with a financial friend by your side! 🚀 #FindYourFinancialFriend #CHIPPros #WealthYourWay