Let’s talk money. Because if we’re being real, generational wealth doesn’t just appear—it takes strategy, patience, and a few moments of staring at your bank account thinking, “How did we get here?”

If you grew up in a household where:

✅ Money was tight

✅ Bills were a mystery

✅ Talking about finances was off-limits

You’re not alone.

But here’s the thing: just because the financial struggle has been the norm in your family doesn’t mean it has to stay that way.

What’s Holding Us Back?

Before we talk about solutions, let’s break down the obstacles:

1. Systemic Barriers

Let’s be real—access to wealth-building tools hasn’t always been fair. Historical injustices, economic disparities, and limited resources have made it harder for many families to get ahead.

🚨 But knowing the game is rigged doesn’t mean you stop playing—it means you play smarter.

2. The Debt Trap

Debt is like that one toxic ex—it keeps coming back, messing up your peace, and making plans feel impossible. Between student loans, credit cards, and high-interest traps, it’s easy to feel stuck. Debt is a tool to help you complete things. Rethinking Debt

💡 The right strategy is your way out.

3. The “Nobody Taught Me” Effect

If your family never talked about money beyond “we don’t have enough”, you’re figuring things out the hard way.

🧠 Financial literacy isn’t just about making money—it’s about keeping and growing it.

4. Money is a Taboo Topic

For some families, talking about money is more uncomfortable than talking about… anything else, really.

🚀 But silence won’t build wealth—conversations will.

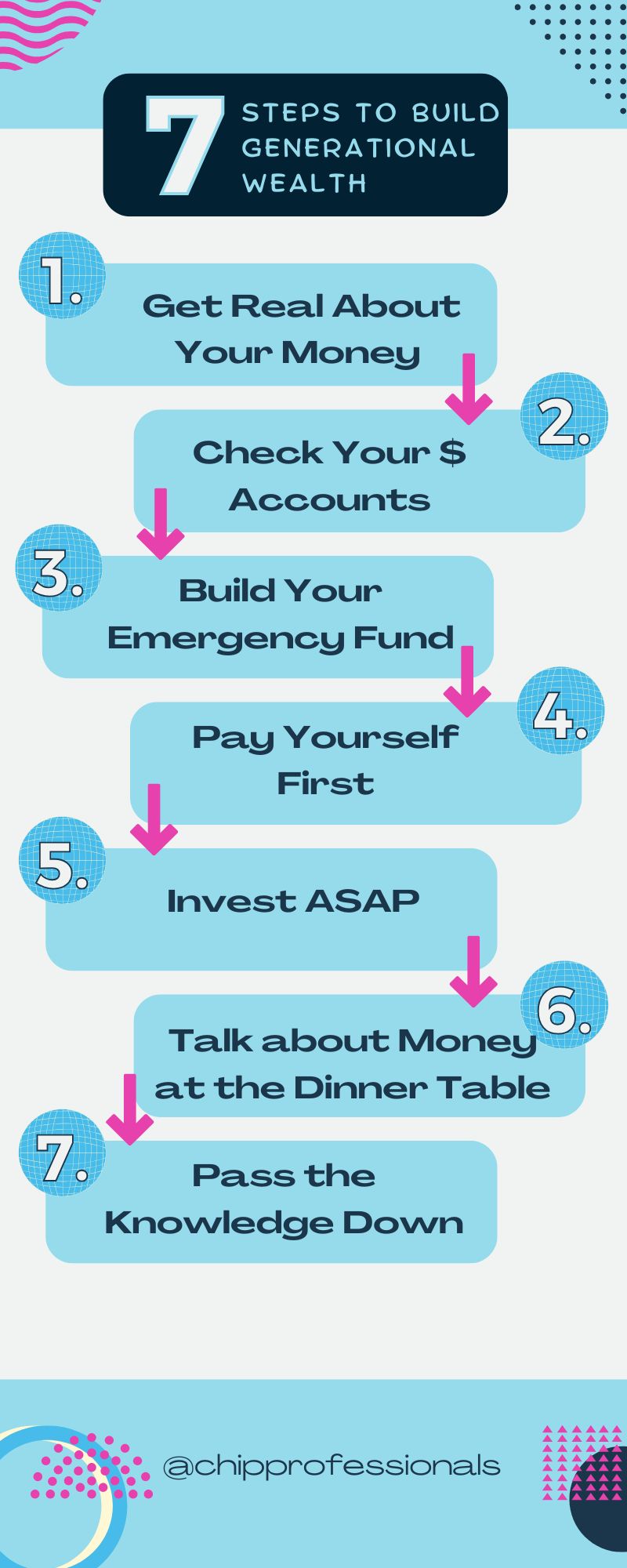

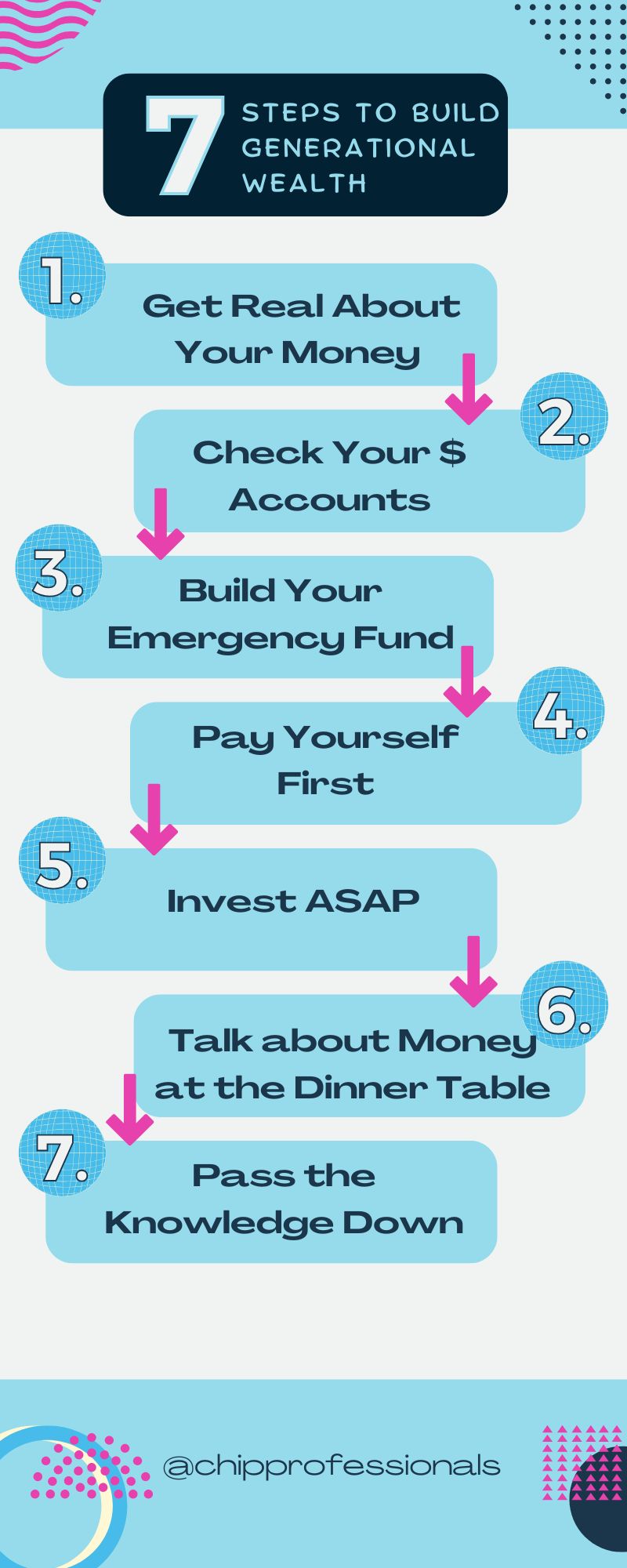

The Game Plan: Steps to Level Up Your Finances

Now that we know what we’re up against, let’s talk about solutions. Because a money glow-up is within reach.

Step 1: Get Real About Your Money

No shame, no judgment. Write down your:

✅ Income

✅ Expenses

✅ Debts

✅ Assets

You can’t fix what you don’t acknowledge.

Step 2: Check Your Bank Accounts

Monitor your checking and savings regularly. This helps you:

✔ Catch unauthorized charges

✔ Track spending

✔ Stay ahead of financial issues

Step 3: Build an Emergency Fund

Start small—$500 for unexpected expenses. Then, aim for 3-6 months of living costs.

📌 Because life be life-ing, and we’re not going broke over a flat tire.

Step 4: Pay Yourself First

Set up automatic transfers to savings. If you don’t see it, you won’t spend it.

💰 Out of sight, into your wealth-building account.

Step 5: Invest ASAP

Open that 401(k) or IRA and start investing yesterday.

📈 Compound interest is your money’s best friend—it gets better with time.

Step 6: Talk Money at the Dinner Table

Normalize financial conversations in your family. Transparency = teamwork.

Step 7: Pass the Knowledge Down

Teach your kids, cousins, and nieces about money early.

Wealth isn’t just what you leave behind—it’s what you pass on.

Real People Who Did It 💡

Vivian Tu (@YourRichBFF)

She made financial education accessible and fun for everyone. Now, she’s helping families build wealth—one TikTok at a time.

🔑 Key Lesson: Financial literacy is your first investment.

Naseema McElroy(@financiallyintentional)

She paid off $1 million in debt (yes, really) by making smart money moves.

🔑 Key Lesson: No debt is too big to tackle with the right strategy.

Money Mistakes to Avoid 🚫

❌ Living off credit cards—use them wisely, not as extra income.

❌ Skipping an emergency fund—because surprises will happen.

❌ Waiting too long to invest—time = money.

❌ Keeping money convos secret—build wealth together.

The Bottom Line

Breaking financial cycles doesn’t happen overnight. It’s about small, intentional steps that set up your future—and the next generation.